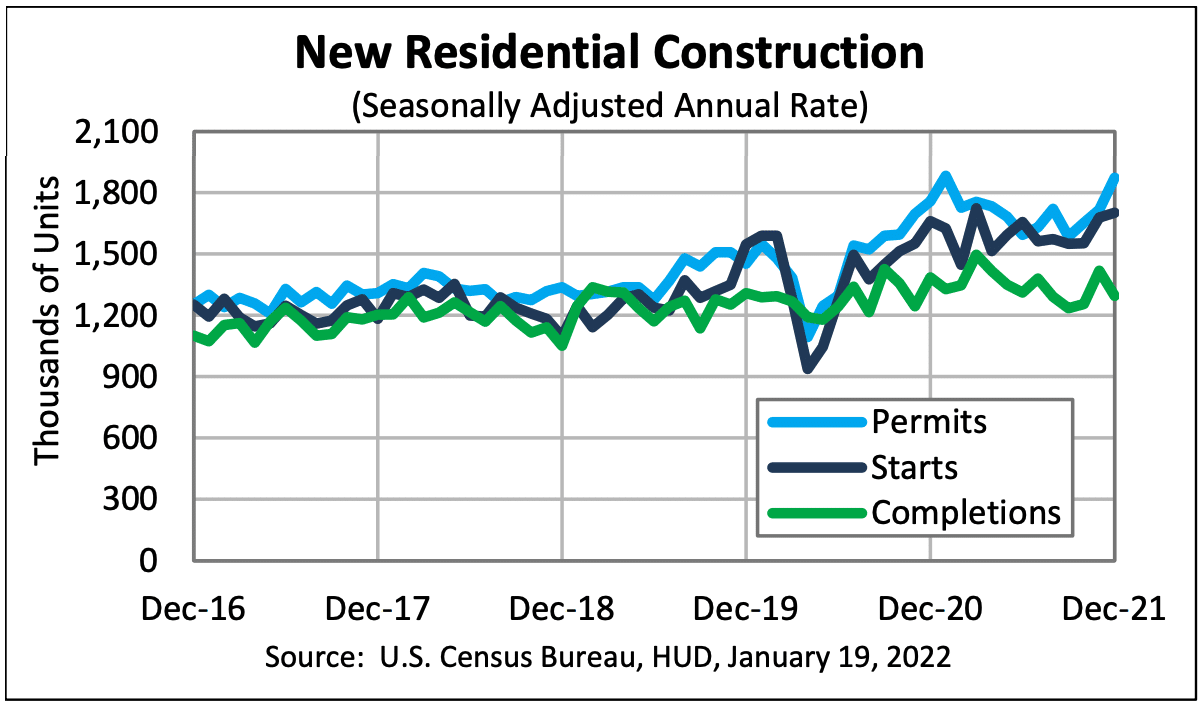

The latest new residential construction report shows signs that housing inventory may finally rebound a bit in 2022. While new completions in 2021 only modestly outweighed new completions in 2020, new housing starts and permits strongly increased in 2021 compared to the previous year. This indicates that new housing completions will likely spike in 2022.

New Housing Permits

An estimated 1,724,700 housing units were granted building permits in 2021, a hefty 17.2% increase from 2020s 1,471,100. Privately-owned housing units approved for building permits in December were at a seasonally adjusted annual rate of 1,873,000, 9.1% above the revised November rate of 1,717,000, and a 6.5% year-over-year increase compared to the December 2020 rate of 1,758,000.

Single‐family permits last month were at 1,128,000, 2% above the revised November figure of 1,106,000, while permits for multifamily buildings totaled 675,000 combined units.

In the Northeast, building permits soared 111.9% from November to December. According to the Census Bureau, this surge was primarily due to building permits issued in Philadelphia, PA. Philadelphia enacted several real estate tax changes for residential projects permitted after December 31, 2021. Developers, therefore, flocked to get permits approved before the new changes go into effect.

New Housing Starts

According to the U.S. Census, construction on an estimated 1,595,100 housing units started in 2021, a substantial 15.6% increase from the 1,379,600 units in 2020. Demand for new housing in 2021 was strong, as a lack of supply and steady demand pushed home prices up all over the country.

Northeast saw the largest increase in 2021. The number of housing units started went up 22.2% year-over-year, many of which were multifamily constructions.

New housing starts in December were at a seasonally adjusted annual rate of 1,702,000, 1.4% more than the revised November estimate of 1,678,000. December 2021 numbers also increased 2.5% compared to December 2020, when new housing starts were 1,661,000.

This past December, Housing starts for single-family homes were at a rate of 1,172,000, which marks a 2.3% decline compared to the revised November figure of 1,199,000. Meanwhile, the December figure for units in multifamily buildings (five units or more) was 524,000.

According to Doug Duncan, the chief economist at Fannie Mae, the new housing construction data is positive news.

“Today’s new residential construction report from the Census Bureau showed that housing activity ended 2021 on a strong note, with construction starts rising 1.4% over the month of December,” says Duncan. “For the year, total housing starts registered at 1.6 million units, the highest annual pace since 2006. Helping drive last year’s strength was the impressive resilience of multifamily starts, which recorded its highest annual total since 1987.”

As Duncan mentioned, 2021 was the strongest year for housing starts since 2006, which was the height of a significant housing boom.

New Housing Completions

Builders completed an estimated 1,337,800 housing units in 2021, a modest 4% increase from the 2020 figure of 1,286,900. December’s housing completions were at a seasonally adjusted annual rate of 1,295,000, an 8.7% decrease from the revised November estimate of 1,418,000. December 2021 completions were also 6.6% below the December 2020 rate of 1,386,000.

When broken down by housing types, single‐family housing completions were at a rate of 990,000, 3.9% above the revised November rate of 953,000. The December rate for units in multifamily buildings (five or more units) was 299,000.

What to Expect in the Coming Months?

Housing has become increasingly unaffordable in many parts of the country. The new housing construction and completions will likely alleviate some of the supply pressure many places are experiencing, potentially reducing bidding wars. Coupled with rising interest rates, prices in key housing markets might stabilize. But keep in mind that the supply chain issue and labor shortage remain constraints.