How to Search Public Property Records

Whenever you engage in a real estate activity, you’ll want to have as much information about properties as possible. Public property records make it easy and convenient to access information about properties, and prospective buyers can look through records to find out more about listings they are interested in pursuing. RealtyHop Property Records provide updated and useful information for those who wish to learn more about a property.

What Are Property Records?

Public property records contain details about closed deals, deeds, tax payments, and ownership that can benefit buyers and sellers. Anytime someone participates in a real estate transaction, their local municipality records information pertaining to the sale, making that information accessible for the public record.

Property records consolidate information from government land and tax records alongside proprietary real estate listings. This information provides a full view of a property’s data in one place.

How to Search RealtyHop’s Property Records Database

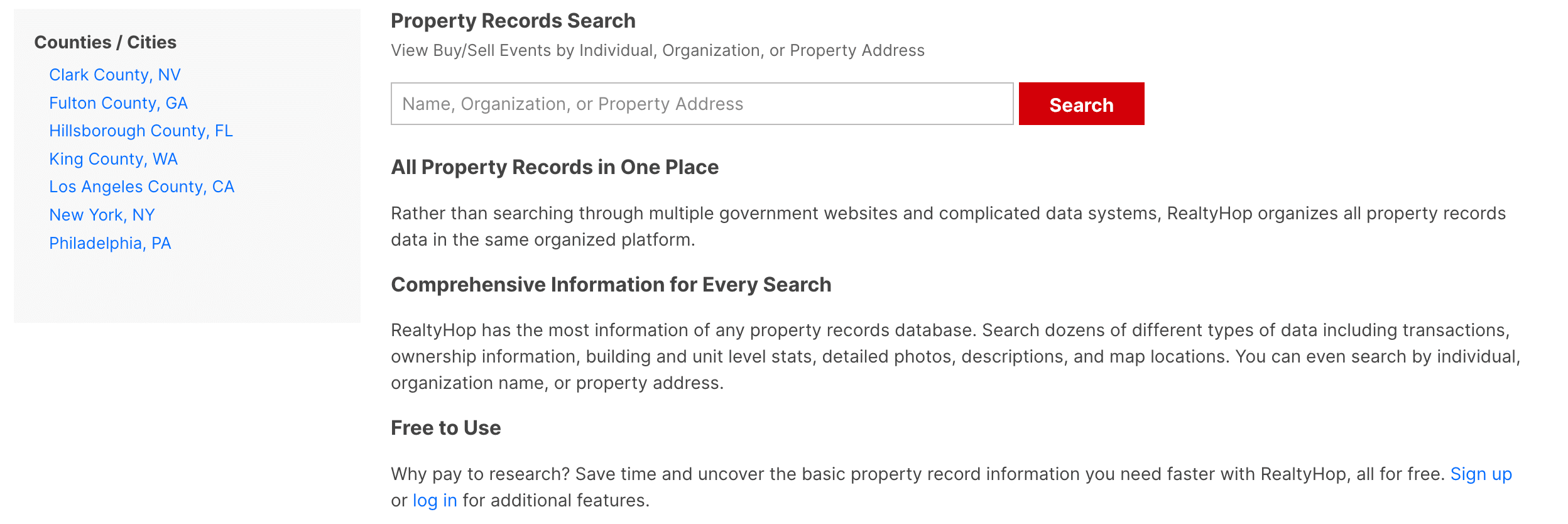

It’s simple to search for property records using the Property Records Search. Users can visit the page and enter a property’s address or search by an owner’s name. The sidebar on the left provides users with the option to refine their search by county or city.

*Photo Contribution: RealtyHop Property Records

After users conduct a search, the page will display all corresponding entries. Buyers or sellers can then click on a party’s name to view all of their transactions or click on the property to view that home’s transaction history.

What Other Information Does RealtyHop Provide?

Various property records may reveal different amounts of information. On ReatlyHop, property records disclose the following information directly on the Property Records Page:

- Date of the transaction,

- Party A and Party B,

- The main action of the transaction (sale, transfer, etc.),

- The address of the property,

- The mortgage amount and the mortgage lender (if applicable),

- The amount spent in the transaction.

RealtyHop provides more information when clicking directly on building pages. Prospective buyers can click on a building page to view the following:

- Sales history for all units in the building (applicable for multi-unit buildings like condominiums and co-ops),

- The number of bedrooms and bathrooms,

- Square footage,

- The asking price and closing price (including monthly charges and calculations of how much above or below the home sold for in relation to the asking price),

- The listed and closed dates (including days on market),

- Buyers.

Prospective buyers can also switch tabs to view active sales, closed deals, and rental units. They can also select to track a property and receive alerts for transactions in the building. This tool can be especially helpful for buyers purchasing in a multi-unit building, as they can directly see real-time data about comparable listings.

*Photo Contribution: RealtyHop

Other property records may include more information, like if two party members acquired a divorce or even who originally built a home. Some property records will charge a membership or usership fee before providing information to curious buyers. RealtyHop Property Records remain a free source of information.

When users create an account or login to their existing account, they then have access to additional information. Account users can view more property records when they complete a search. It is free to create an account on RealtyHop.

Ready to run your search? Click here to create an account.

Where Else to Find Public Property Records

Apart from online property records databases, potential buyers can also visit a county’s tax offices or deed recorder offices. Though it is typically easier to search online, someone can physically visit an office to learn more about themselves or a property they’re interested in purchasing.

How to Utilize Property Records When Buying a New Home

Public property records can be a powerful tool for homebuyers looking to acquire more information about homes they wish to buy. Buyers can learn the following by using property records:

1. Research Cost History

Buyers can research a home to see how much it sold for in the past, along with how much buyers could acquire on a mortgage. This can build perspective and help buyers differentiate the financial pros and cons of several different properties. Buyers can also look at various properties to compare their price history and determine which homes typically sell for more than others.

Additionally, buyers can see how much a property increased in value between every transaction and consider its appreciation rate year-over-year. That information can be helpful for those who anticipate that they will sell their property down the line, as they want to ensure they purchase a solid investment.

2. Research Real Estate Agents

Prospective buyers can utilize property records on RealtyHop to find detailed information about real estate agents. Property records disclose the names and brokerages of real estate agents who conducted a sale on a respective property. In a multi-unit building, a buyer may decide to hire an agent who previously closed another sale in the building as they know they have expertise and knowledge of the buildings. Buyers can also look for agents who work in the neighborhood, at their price range, and who recently closed deals to find qualified agents.

Learn more: How to Find the Ideal Realtor for Your Next Purchase

3. View the Number of Transactions in Recent Years

While homeowners sell their properties for plenty of reasons, buyers may take notice of a property that sells fairly often. If a property has a high rate for turnover, it can prompt them to ask their agent why sellers continue to place the home on the market. On the other end, prospective buyers may take comfort in knowing that a home on the market fairly often has passed several home inspections.

4. Research Comparable Properties

Buyers and sellers can use property records to compare properties against each other. RealtyHop automatically suggests comparable listings to page visitors to help them find similar listings in the area. Additionally, buyers can compare asking and closing prices across properties, their square footage, and information about the agents who worked on previous transactions.

5. View a Potential Cap Rate or Net Operating Income

Potential investors can utilize the cap rate feature to determine their potential return on investment. RealtyHop provides a net operating income (NOI) and cap rate to help investors visualize the amount of money they can generate through renting their property.

Learn more: Cap Rate – What Is It and Why Is It Important?

How to Utilize Property Records When Selling a New Home

Home sellers can also utilize property records to understand more about comparable properties and determine how to navigate the market.

1. Determine an Asking Price

Sellers can use property records to find how much other owners list their homes for and their eventual closing price. This can influence a prospective seller’s asking price and help them confidently engage in conversations with their agents to determine their listing price. Sellers can directly see how much homes sold for in the current market to determine an appropriate asking price properly.

2. Analyze Days on Market for Comparable Properties

Additionally, property records disclose how long a listing stays on the market, so sellers can use days on market metrics to anticipate how long it may predict their home to sell. While every home in every market may not sell in the exact same time frame, sellers can anticipate an eventual close date to determine their own timeline for purchasing a new home or moving into a different living situation.

3. Find an Agent

If a seller does not yet have a real estate agent, they can view comparable listings in their area and find agents who closed transactions. They can see if that agent typically sells homes for above or below the asking price, how long homes stay on the market, and how many sales the agent recently closed.

This information can help clients understand if an agent is a right fit for them. An agent who typically sells homes in the two to three-million dollar price range may not be as appealing to someone looking to list their $600,000 property as an agent who specifically deals with properties under one million dollars.

How Real Estate Agents Utilize Property Records

Real estate agents can also benefit from using property records to communicate with their clients. While agents typically have expertise in their area and the price point they work in, they gather additional knowledge by looking at recently sold comparable listings. They can then accurately present real-time data to their clients to help inform their decision-making processes.

Conclusion

Buyers, sellers, investors, and real estate agents benefit from using property records to access information about properties in their area. Through searching comparable listings, users can generate a sense of how various listings in their area perform, who handled those transactions, and how much income a property can generate down the line. The RealtyHop Property Records search allows users to search for a party or property to learn more about that listing. Property records serve as a bountiful source of intel that helps those participating in real estate make informed decisions.