Getting a mortgage is something that thousands and thousands of people do every single month in the USA. If you have ever gotten a mortgage (or considered getting a mortgage) in the USA, there is a good chance that you have heard the names Freddie Mac, Fannie Mae, and Ginnie Mae.

But just what do these names mean? In an effort to help you out, we have decided to craft an article that will take a look at each individually, as well as the similarities and differences between them.

What is Freddie Mac?

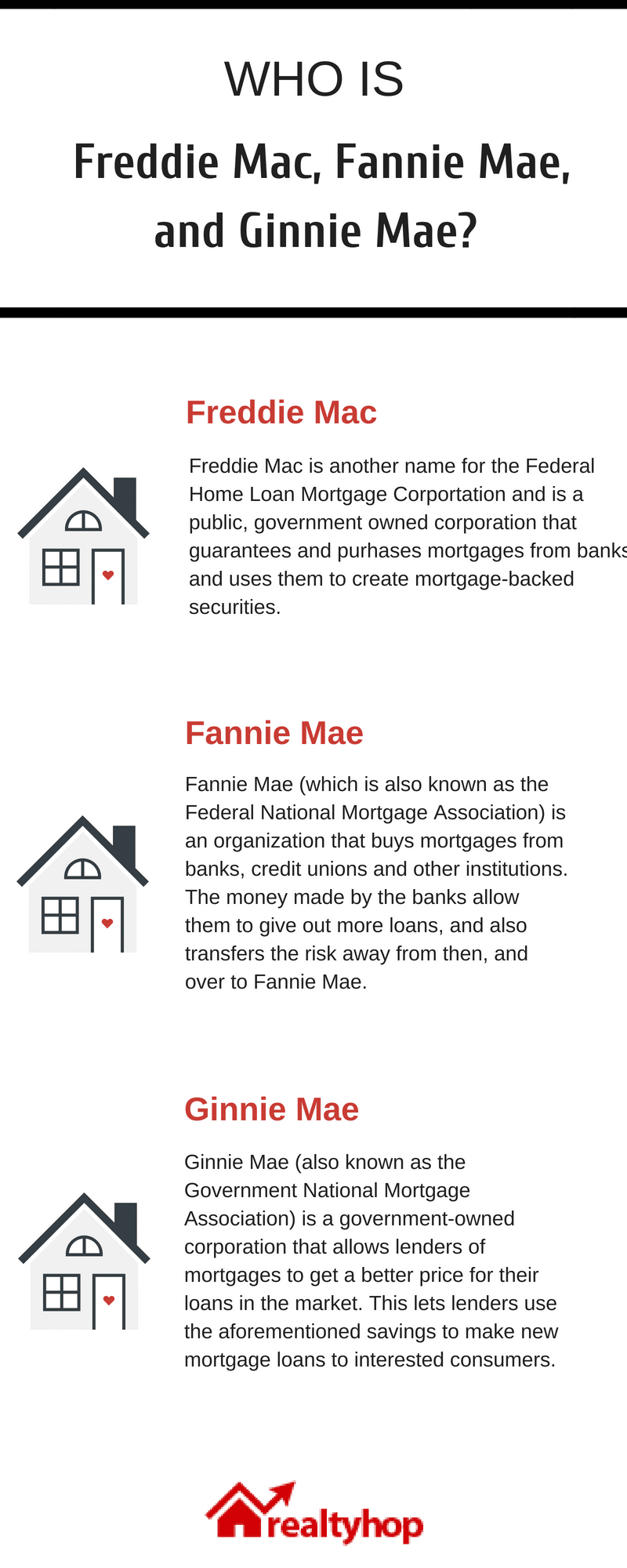

Freddie Mac is another name for the Federal Home Loan Mortgage Corporation (FHLMC) and is a public, government-owned corporation that guarantees and purchases mortgages from banks and uses them to create mortgage-backed securities. These securities are then sold on the secondary market to investors who want to become involved in the real estate sector. However, some of the mortgages they purchase are kept as investments, as well.

Freddie Mac makes most of their revenue from charging the guarantee fee on loans that it has purchased. Investors allow for Freddie Mac to keep this fee, in return for taking on the risk of the loan, meaning investors will know how much they will get paid every month. Banks normally use the money garnered from the sale of the mortgage to provide new loans for potential homebuyers, which helps to boost the housing market in the country. Without options like Freddie Mac, banks would have a ton of money tied up in loans, which would prevent new loans and would also be quite risky for the banks.

Freddie Mac was created back in 1970 when Congress passed the Emergency Home Finance Act. It was founded in an effort to keep money going to mortgage lenders, with the goal of supporting home ownership in the country. Also, it was created to help reduce the interest rate risk for various banks.

Freddie Mac affects the economy by not only helping banks provide more mortgages but also by helping lower interest rates and helping those rates stay consistent. Freddie Mac is a GSE (government sponsored-enterprise) and nearly 80% of all mortgages in the USA are backed by Freddie Mac and another GSE, called Fannie Mae.

What is Fannie Mae?

Fannie Mae (which is also known as the Federal National Mortgage Association) is an organization that buys mortgages from banks, credit unions and other institutions. The money made by the banks allow them to give out more loans, and also transfers the risk away from then, and over to Fannie Mae.

Similar types of loans are then packaged by Fannie Mae into mortgage-backed securities, which are then sold to investors of all kinds. They also make money on the “guarantee fee” that they charge customers to take on all of the risks. Despite that, there are a few risks the investor will take on, such as if the mortgage is paid off early or if interest rates fall.

Currently, Fannie Mae is under conservatorship of the Federal Housing Finance Agency and the U.S Department of Treasury owns all of its preferred stock. Fannie Mae was created back in 1938, with the purpose of providing and establishing a secondary market for the mortgage loans that were insured by the FHA (Federal Housing Administration).

Before the financial crisis, Fannie Mae helped to stimulate the housing market, which was a large part of the U.S economy. They helped homeowners and potential buyers alike. But after the crisis, it (along with Freddie Mac) has been essentially keeping the housing market on life support, as many banks won’t lend to many people without some sort of government guarantee.

As you can see, Fannie Mae and Freddie Mac are quite similar, except for the fact that Fannie Mae often buys their mortgages from large banks, while Freddie Mac normally works with smaller banks to acquire loans. They are essentially competitors, with a very similar business model and way of doing business.

What is Ginnie Mae?

Last, but not least, is Ginnie Mae. Unlike the other two we have talked about today, Ginnie Mae (also known as the Government National Mortgage Association) is a government-owned corporation that allows lenders of mortgages to get a better price for their loans in the market. This lets lenders use the aforementioned savings to make new mortgage loans to interested consumers.

Unlike Freddie Mac or Fannie Mae, Ginnie Mae doesn’t sell or buy mortgage-backed securities, or loans. Instead, institutions that are approved by Ginnie will actually do the creating and selling of loans and securities. In a sense, they simply just guarantee an accurate and on-time payment of interest and principal from banks.

So the investor who invests in a Ginnie Mae security, will not know who the issuer of the mortgage is or anything like that, but they will know it is guaranteed by Ginnie Mae. This is good news for the investor, as Ginnie Mae is backed by the U.S Government, similar to the U.S Treasuries. As a result, investors do not need to worry about missed or late payments or even mortgage defaults, as Ginnie Mae will step in to make those payments.

Ginnie Mae was originally established back in 1968 and was the first to create and guarantee mortgage-backed securities, back in 1970. They are a huge help in keeping the housing industry moving forward by providing new lending (and borrowing) opportunities.

In conclusion, we hope that this article has helped you understand just who Freddie Mac, Fannie Mae and Ginnie Mae are, and just what they do.