Most of the major decisions we have to make in life will end up being about our credit scores, from applying for credit cards to buying a new car. Our credit scores also play a big role when we apply for new jobs – the credit score is usually part of the background check report. If you have never had a credit score and never had the need – lucky you (while most of us are like, “how is it possible?”, some people, in fact, live their lives just fine with no credit score or credit history). But hey, if you are planning to buy a house, the fact that you don’t have a good credit score will most certainly be a deal-breaker.

In case you are unfamiliar with the credit system in the U.S., a credit score is a statistical three-digit number that predicts how likely a consumer will repay his or her debts. It is, in general, very difficult for lenders to predict if a mortgage applicant would be able to make mortgage payments on time, and so, they rely on credit scores to tell them if a person is financially stable and trustworthy. If you are planning to buy a house, chances are that you will need to apply for a mortgage. It is, then, imperative that you have a good or even excellent credit score. Having a good credit score gives you more options when getting a mortgage, as more lenders will consider lending you money. A good credit score may also help you get a lower interest rate, which means less money putting in interest over the life of the loan.

So, how does it work? To understand how your credit score is calculated, let us first talk about the system. The FICO (Fair Isaac Corporation) Score is by far the most commonly used credit-scoring system, and it ranges from 300 to 850. Below is a credit score scale chart that shows different credit score categories and their ranges.

| Exceptional | 800 and above |

| Very Good | 740 – 799 |

| Good | 670 – 739 |

| Fair | 580 – 669 |

| Poor | 580 and below |

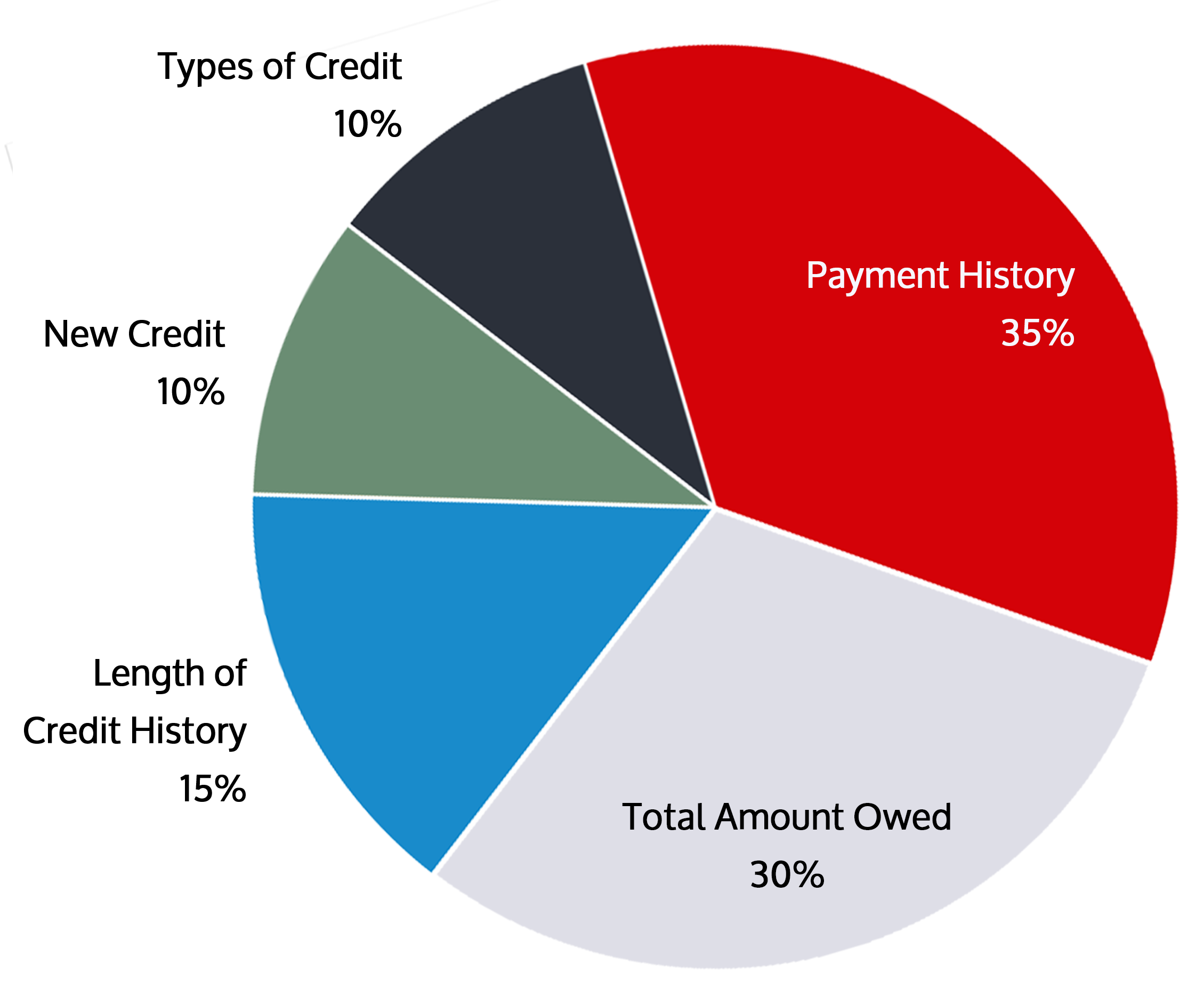

FICO, as well as other credit-scoring systems, look at a few things in the credit report when calculating a person’s credit score:

- Payment History: Your payment history has the greatest impact on your credit score. If you have always submitted payments on time, chances are that you have a good credit score. Late or missed payments, conversely, drag down your credit score.

- Total Amount Owed: This takes into account the percentage of credit available compared to credit used, commonly known as credit utilization, of all the accounts you have. Lenders, in general, like to see 30% or lower credit utilization.

- Length of Credit History: When we check if someone is trustworthy, we look at his/her past behavior, and the same logic applies here – credit scoring models look at how long you have used credit, and the average age of all of your accounts (both old and new, and therefore, do not close out old accounts). Longer credit histories are generally considered less risky, as there is more data to determine your creditworthiness.

- New Credit: It takes into account how many open accounts you have, and how many new ones you have applied for recently.

- Types of Credit: To get a good credit score, it is encouraged that you have a mix of credit accounts, including revolving and installment.

By this time, you should have gone over your credit report carefully or have checked your credit score. If your credit score is over 700 – congratulations! If your credit score is below 650, instead of starting shopping for houses, take the following steps first to take to improve your credit score:

1. Repay all credit card debts as soon as possible.

2. Go through your credit report and dispute any errors. It would probably take you a couple of hours to do this. If you do not have time, you can also hire a credit repair service.

3. Do not close out old accounts – again, the number of open accounts matters when it comes to building up your credit score.

4. Apply for credit cards that are for building credit, such as secured credit cards. Secured credit cards are very popular among people looking to build or rebuild their credit history. As a secured credit cardholder, you are required to make a deposit with the bank equal to your credit limit. If at any point, you are unable to repay the debt, your bank will then use the funds held as the deposit to cover the defaulted amounts. You might also want to speak to your bank and find out what credits cards they offer – it is often easier to get approved for a credit card if you have an account with the bank, and many of them offer unsecured credit cards are designed to help you build your credit score.

***

Your credit score is the first thing you should take care of before starting your home search. In addition to this blog post, you might also find these helpful:

-

- What Is A Mortgage?

- 5 Things to Do Before You Go House Hunting

- 10 Tips for First Time Homebuyers Part I & Part II