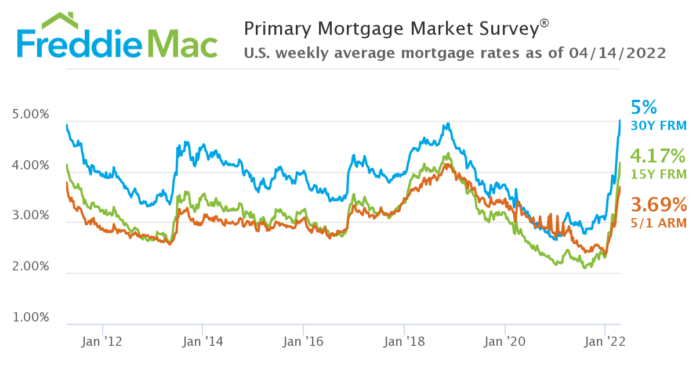

According to Freddie Mac, the average interest rate for a 30-year fixed-rate mortgage reached 5.0% on Thursday, April 14. Interest rates haven’t reached 5.0% since 2018 when the 30-year fixed rate hit 4.94% at one point in November. It mirrors the numbers seen in February 2011, which was a tough season for the housing market. Housing prices moved up steadily in 2009 and 2010 in the wake of the financial crisis but fared poorly in 2011. The housing market depreciated 5.8% in the second quarter of 2011 and 3.9% in the third quarter of the year.

Real estate experts don’t expect the housing market to depreciate throughout 2022, but high interest rates are a problem for the market. Interest rates on a 30-year fixed-rate mortgage averaged around 3.0% at this time last year, representing only 60% of today’s rate. In simple terms, borrowing costs are 40% higher than a year ago.

The higher borrowing burden, coupled with rapidly rising home prices, is a major barrier for prospective homebuyers who are already priced out of the current market. In fact, 70% of Americans can’t afford a median-priced home. As a result, the number of Americans renting keeps increasing, and buyers have to spend more of their savings and income on a home purchase.

“While this may still turn out to be a blip, it is increasingly looking as if a combination of substantially higher mortgage rates and a steep run-up in house prices is having a cooling effect on demand,” Joshua Shapiro, chief U.S. economist at MFR Inc., said in a research note.

According to the Mortgage Bankers’ Association’s (MBA) Purchase Composite Index, the rise in mortgage rates led to a temporary jump in mortgage applications. Their data found that mortgage loan applications for single-family homes increased 1.4% compared to last week. The rise in mortgage applications may seem counterintuitive, but prospective buyers want to lock in rates before further increases. In the same report, the MBA predicted that mortgage originations would decline by 35.5.% in 2022.

Joel Kan, an economist with the MBA, said, “Mortgage rates across all loan types continued to move higher, with the 30-year fixed-rate exceeding the 5% mark – the highest since November 2018. Refinance activity as a result declined to the slowest weekly pace since 2019”.

When mortgage interest rates were low throughout 2020 and 2021, demand for mortgage refinancing skyrocketed as homeowners rushed to refinance with lower interest rates. The MBA found that, with skyrocketing rates, demand for refinancing cratered. Applications to refinance a home loan fell a seasonally adjusted 5% over the last week. More dramatically, refinance applications are now 62% lower than a year ago. Over the course of 2022, the MBA predicts that mortgage refinances will fall by 64%.