An origination fee is a fee lender charges for setting up a loan. Depending on the lender, sometimes the mortgage origination fee is split into “underwriting fee” and “processing fee.” When shopping for a loan, you should be aware of the various fees associated with the loan you are getting. These fees are bound to increase your closing costs.

This article aims to provide insights into the origination process and fees to help you get the best deal when shopping for a loan.

What is Loan Origination?

Loan Origination describes all the processes that occur when a borrower seeks to obtain a loan. Whether you apply for a mortgage or even an auto loan, all the stages that characterize your loan acquisition are part of loan origination.

What Does the Loan Origination Process Involve?

Loan origination involves several stages starting from the initial loan application by the borrower to the disbursal of the loan. A typical loan origination process contains the following steps:

- Pre-Qualification: The borrower receives a detailed list of items they need to submit to the lender to acquire a loan. These items may include proof of address, government ID, credit score, employment information, bank statement, amongst other things.

- Loan Application: The borrower fills out a loan application form. The loan application may be paper-based or filled via a lender’s mobile app or platform.

- Application Processing: The lender’s credit department receives the loan application and reviews it for accuracy and correctness. These days, lenders employ the use of Loan Origination Systems (LOS) to process loan applications.

- Underwriting Process: Upon completing the loan application by the borrower, the lender starts the underwriting process. Now the lender looks at specific underwriting standards and evaluates a borrower’s eligibility for a particular loan program. Thanks to technology, lenders nowadays utilize automated solutions like rule engines to underwrite loans.

- Credit Decision: A loan application may be approved, denied, or readjusted to meet the lender’s criteria based on the outcome of the underwriting process. Sometimes, lenders may request a higher down payment or a reduced loan amount.

- Quality Checks: Due to the highly regulated environment of the U.S. loan industry, a quality check is required on all loan requests. Lenders may have to send the loan application to a quality control team to ensure the application complies with the respective loan program guidelines.

- Loan Funding: The loan funding process starts immediately after the lender and borrower have executed the loan documents. Home loans and second lines of credit may require a longer funding timeline.

After the loan origination process, the next step is usually the loan servicing or loan repayment process. The repayment method, amount, and payment schedule are generally determined by the lender with the borrower’s approval.

What’s A Mortgage Origination Fee?

An origination fee is a fee charged by a lender to cover the cost of processing a loan. The fee is typically a small percentage of the potential loan amount, and it covers the lender’s customer service while extending you the loan.

Additionally, origination fees help the lender cover the cost of some tasks needed to secure the loan. These tasks may include getting a borrower’s financial information, arranging application documents, and verifying documents. Sometimes it involves cross-referencing to determine which government-backed loan programs a borrower may qualify for.

Another essential fact to keep in mind when searching for a loan is that some lenders may lump the fees into one sum or break the cost down for the loan application, documenting, preparation, and underwriting separately. Whatever the method your lender applies, you must request a loan estimate that includes all the information about the cost of the loan.

How Much Are Loan Origination Fees?

Origination fees vary. Generally, they average around 0.5% to 1.5% of your total loan amount. However, they can fall outside this range in some instances.

Here’s a breakdown of what a 1% mortgage origination fee would look like in different loan amounts:

- $300,000 loan = $3,000

- $400,000 loan = $4,000

- $500,000 loan = $5,000

- And so on…

Ultimately, the origination fee on your loan will be dependent on several factors such as credit score, lender, loan amount, and financial situation. Origination fees can vary by lender, and there is no set amount on what each one charges.

Where Do I Find My Origination Fee?

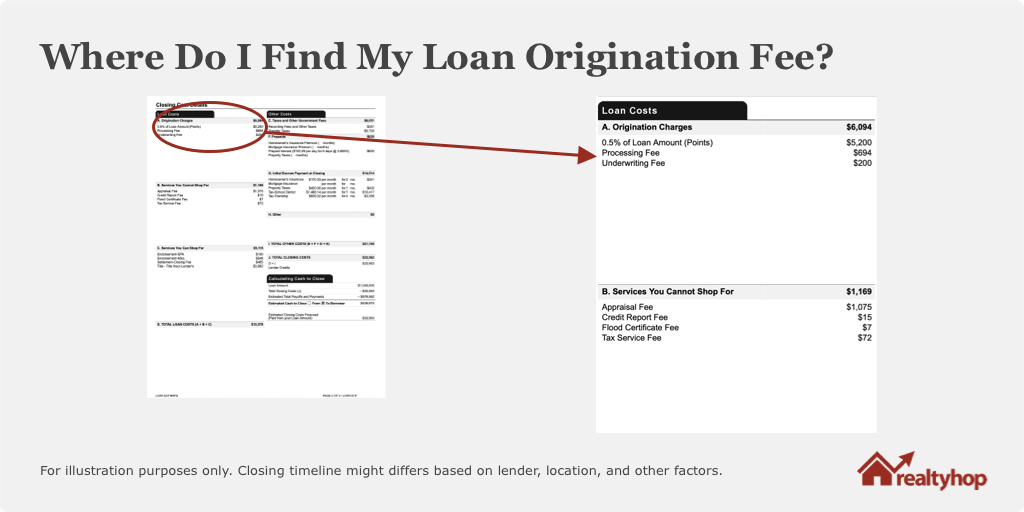

More importantly, you can find the origination fees under section A on Page 2 of your Loan Estimate or Closing Disclosure.

Origination Points vs. Discount Points: What’s the Difference?

The origination fee is also commonly referred to as an “origination point.” One point equals 1%, and half a point is just another way to describe 0.5%. But do not confuse it with “discount points” or “discount fee.” Let’s discuss how they differ.

Discount Points

In a simple explanation, discount points are fees paid to a lender to lower or “buy down” your mortgage interest rate, thereby reducing your potential monthly payments. The more discount points you pay, the lower your interest rate will be. Therefore, a loan with no or zero points will carry a higher interest rate than a loan with several discount points.

The worth and impact of each discount point on your interest rate vary across lenders and loan programs. In general, each discount point you buy has the potential of lowering your interest rate by 0.125% to 0.25%.

How Much Do Discount Points Cost?

Typically, one discount point has a fixed cost of 1% of your possible loan amount. For example, one discount point would be $2,000 if you’re looking to borrow $200,000. With a 4% interest rate and a loan amount of $200,000, your monthly payment would hover around $955/month.

By purchasing one discount point or paying $2,000 upfront, your interest rate may drop to 3.75% from 4%, thereby reducing your monthly payments by $29 each month. Since discount points vary across lenders, you should endeavor to read the fine print on a loan estimate before opting for a lender.

Do I Have to Pay an Origination Fee?

There is no straight answer to this question. While some lenders advertise that they offer loans with no origination fees, they are more likely to factor the cost of the loan process into other areas, such as the interest rate.

However, it’s not always the buyer who has to cover the origination fee. Home sellers may be willing to cover the origination fee or pay what is referred to as seller concessions. It is quite common for sellers to pay the origination fee if the home has been on the market for a while, or if they have an urgent need for cash.

Lenders may also decide to cover the origination fee by offering borrowers lender credits to cover closing costs in exchange for a higher interest rate or loan amount. However, if you plan to own the property for a long time, taking lender credits would be a wrong move.

Ready to buy? Check out today’s rates and get pre-qualified in less than 5 minutes.